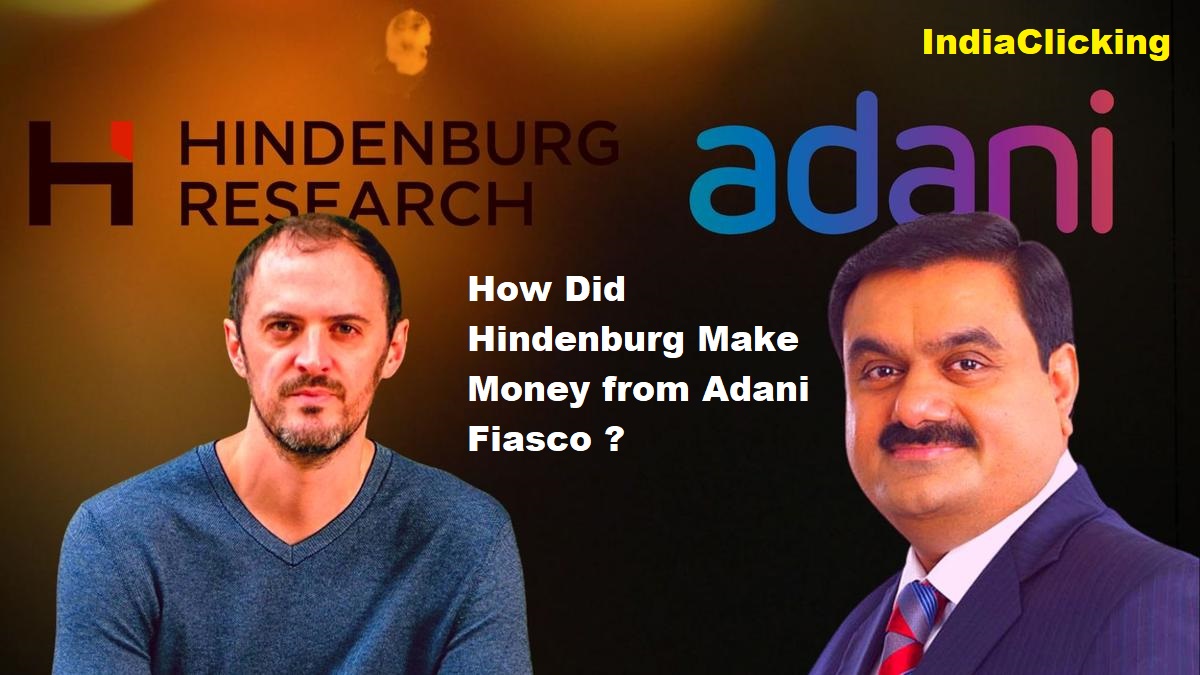

Adani fiasco and ultimate beneficiary was US short seller Hindenburg, who lost the most the retail investors. Hindenburg report triggered $100 billion rout in the share price of Adani Group with a week. The report was publicized without any clarification on Hindenburg interest in it.

Post publication of research report, an initial probe by government agencies has revealed that the bear cartel targeted Adani companies through the use of structured product derivatives (SPDs), nothing known much about it but a potent stock market instruments, tailor-made by foreign brokers for large clients in offshore jurisdictions. These SPDs are similar to the controversial participatory notes in many ways since the identity of the actual clients stays hidden, unless the regulators lift the veil.

As per SEBI short selling of Indian listed stocks outside the country’s jurisdiction is illegal unless they are listed on any exchange. But the probe reveals that a nigh volume of trading took place in Adani group stocks outside the country, which led the volatility in the domestic share market. Who was the biggest overseas short seller in Adani stocks was Hindenburg, which claimed to have targeted the group citing fraud and sky high valuations.

On January 24, Hindenburg revealed: “held short positions in Adani companies through bonds and non-Indian-traded derivative instruments.”

While Adani bonds are listed on the US exchange, Hindenburg’s reference to the ‘non-Indian-traded derivatives’ activatd the Indian regulators. If believes on businessline reports then these non-Indian-traded derivatives are nothing but SPDs. It was very difficult to create panic among the adani stocks as more than 90 per cent of the float was held by promoters, entities close to them and domestic institutions and this was only reason for the higher valuation of the Adani listed companies, a demand-supply mismatch.

The plan for short selling was started a month earlier to Hindenburg report, which was published on January 24, just a day ahead of the monthly derivative market expiry in India and just before Union Budget, when volatility is usually high.

When foreign brokers sell SPDs on Indian underlying to their confidential clients in tax havens and offshore jurisdictions, they themselves or through their associates registered as foreign portfolio investors (FPIs) in India try to partly hedge their positions on Indian exchanges. This hedge of the FPIs, who had shorted Adani stocks overseas, led to rise in bearish bets on Indian markets.

How was it planned ?

- Data reveals there was frantic trading in NSE’s equity options segment starting from December 2022 up to the Union Budget.

- Due to this, the ratio of Put options, which investors buy when they anticipate a market crash, kept rising steadily and touched a 13-year high on January 24: the day Hindenburg published its report.

- On January 23, the Put and Call ratio stood at 0.73 (73 Puts against 100 Calls) and touched 0.74 the next day, which is the highest reading since the peak of the Great Financial Crises in March 2009, when the ratio touched 0.75.

- This shows that the Puts were being added frantically in the Indian indices till Union Budget though global stock markets were steady or rallying.

- It is believed that high action seen in Put options of Adani stocks, means someone was anticipating prices to be fallen down.

- On February 1, the market was at peak post budget but short selling by FPIs ensured that the markets closed in the negative and Adani stocks crashed well before follow-on public offer (FPO).

How does Hindenburg report suspicious ?

- Hindenburg is not a registered research firm with any market regulator.

- The Hindenburg so called report via the right to information (RTI) was rejected by SEBI and informed that it was never share.

- Hindenburg is not yet disclosing the method to short sell the Adani stocks.

What are SPDs?

The structured product derivatives (SPDs) are the most powerful strategy for short selling stocks. The SPDs functions like i.e. If trader “X” is bearish on a particular stock or market but does not want to take direct position, he may approach a foreign broker, who after a thorough risk assessment, will sell him the Put options of the underlying with some spread and higher than usual brokerage commission. Know – What is short position in stock market ?

When the price of the underlying asset falls, trader X will benefit without any direct position in India. Instead, the broker who sold the SPD to the client will take position in India through various entities in a way that does not raise any alarm. It is believed that Hindenburg choose in “non-India-traded derivatives of Adani.” The colossal weight of this overseas short selling fell on Adani stocks in India, which, despite extremely low floating stock, suffered a historic rout. Earlier the same method was tried in Twitter deals also but could not be succeeded.

SPDs can consist of anything in the debt, equity, and commodity universe for short selling and are sold for one-three month periods. Strategies like ‘total return swap’ consisting Puts, or selling Calls are popular.

Leave a Comment