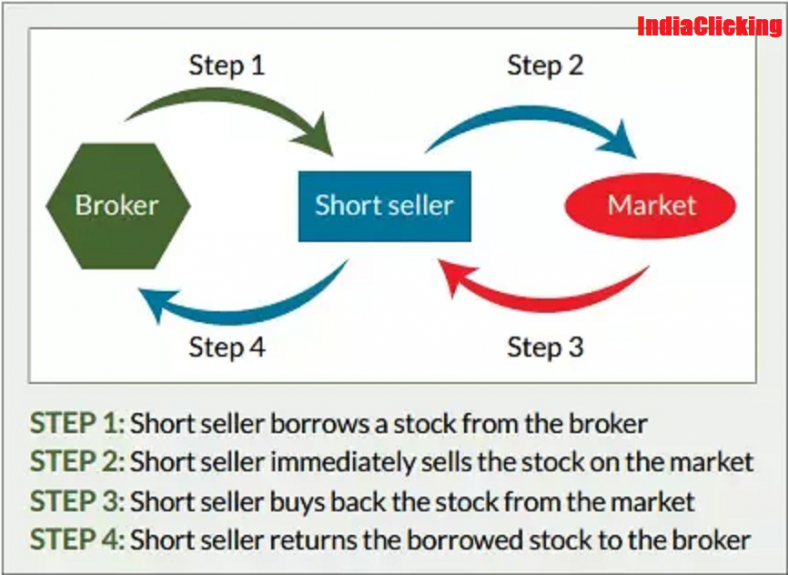

Short position in stock market is a “short” position, which is generally the sale of a stock by the trader who borrows the shares from the broker on the loan or simply the Intraday. In general, the seller doesn’t own the share. Investors who sell short believe that the price of the stock will decrease in value.

If the price drops, investor can buy the stock at the lower price and make a profit. If the price of the stock rises and you buy it back later at the higher price, you will incur a loss.

A short sale is the sale of a stock that an investor does not own or a sale which is consummated by the delivery of a stock borrowed by, or for the account of, the investor. Short sales are normally settled by the delivery of a security borrowed by or on behalf of the investor. The investor later closes out the position by returning the borrowed security to the stock lender, typically by purchasing securities on the open market.

Also Read – GICRE – Should I Invest or Sell it ?

Investors who sell stock short typically believe the price of the stock will fall and hope to buy the stock at the lower price and make a profit. Short selling is also used by market makers and others to provide liquidity in response to unanticipated demand, or to hedge the risk of an economic long position in the same security or in a related security. If the price of the stock rises, short sellers who buy it at the higher price will incur a loss.

Brokerage firms typically lend stock to customers who engage in short sales, using the firm’s own inventory, the margin account of another of the firm’s customers, or another lender. As with buying stock on margin, short sellers are subject to the margin rules and other fees and charges may apply (including interest on the stock loan). If the borrowed stock pays a dividend, the short seller is responsible for paying the dividend to the person or firm making the loan.

Advise : Short selling is for the experienced investor with high level of risk.

Leave a Comment